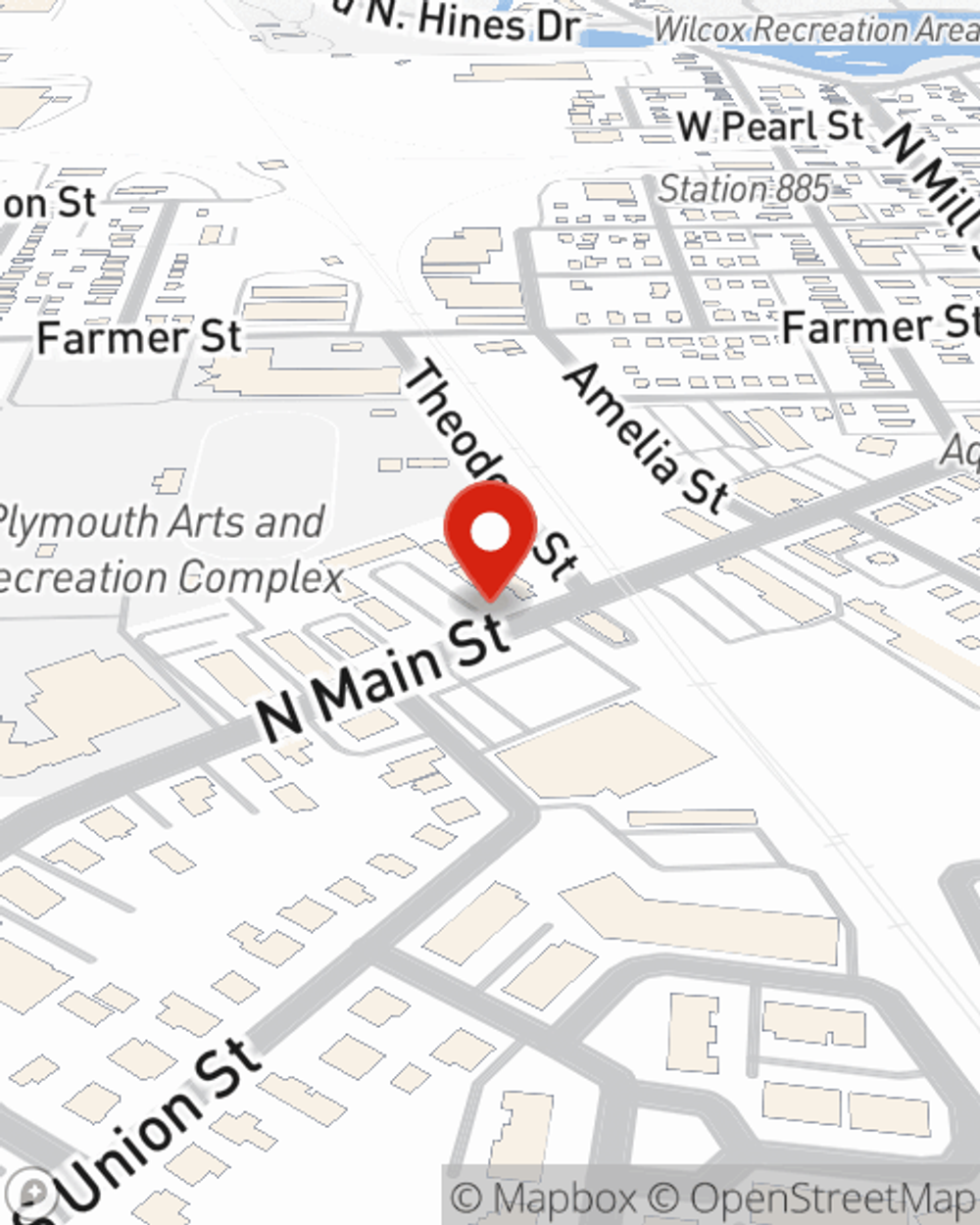

Business Insurance in and around Plymouth

Plymouth! Look no further for small business insurance.

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

You may be feeling overwhelmed with running your small business and that you have to handle it all by yourself. State Farm agent Nick Nestorovski, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you customize a policy that's right for your needs.

Plymouth! Look no further for small business insurance.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your income, but also helps with regular payroll overhead. You can also include liability, which is important coverage protecting you in the event of a claim or judgment against you by a visitor.

Reach out to the outstanding team at agent Nick Nestorovski's office to uncover the options that may be right for you and your small business.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Nick Nestorovski

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.